Priority Sector Lending Meaning

Priority Sector Lending Meaning

Priority sector plays an of import role inward the economical evolution of the country. Therefore, the Central (Federal) Government of whatever province gives this sector priority (first preference) inward obtaining loans from blogspot.com//search?q=what-is-bank-introduction-definition">banks at a depression charge per unit of measurement of interest. This is known equally a ‘Priority Sector blogspot.com//search?q=what-is-bank-introduction-definition">Lending’.

Following of import points comprehend the pith pregnant of priority sector lending:

- Priority sector lending system is a policy of providing a specified part of banking concern lending to the of import sectors of the economy.

- It includes agriculture, small-scale industries, cottage sector, tiny sector, export sector, together with other pocket-sized trouble organisation (service) firms.

- The Reserve Bank of Republic of Republic of India (blogspot.com//search?q=what-is-bank-introduction-definition">RBI) was commencement to initiate priority sector lending system inward India.

- The original operate of this system was to consider that timely together with sufficient credits (loans) are given (provided) to the priority sector.

- Previously, exclusively populace sector banks were asked to give loans to this sector. However, at i time fifty-fifty private together with unusual banks cause got to give loans to this sector.

Areas Under Priority Sector

Areas Under Priority Sector

RBI has divided the priority sector into next 10 areas or categories.

The original areas nether priority sector lending system are equally follows:

- Agriculture sector.

- Small-scale industrial loans.

- Small route together with H2O carry operators.

- Professional together with self-employed.

- Retail blogspot.com//search?q=what-is-bank-introduction-definition">trade loan.

- Educational loan.

- Housing loan

- Consumption loan

- State-sponsored corporations for SC/ST.

- Other recommended priority sectors.

Now let's utter over private areas nether priority sector lending i past times one.

1. Agriculture sector

In India, almost one-third of its national income come upward from the agriculture sector. Its economical together with social evolution direct depends on the expansion of the agriculture sector. Therefore, it is treated equally primary priority sector lending inward India.

Agricultural loans are given to the farmers on their need-based credit.

These loans are classified into next 2 categories:

- 1. Direct Agricultural Loans

Under this category, loans are direct given to the farmers inward cast of tractor loan, dairy loan, crop loan, etc. These loans are given either for a short-term menstruum (which is non to a greater extent than than 12 months) or for a medium together with long-term menstruum (which is non to a greater extent than than 36 months).- Short-term loans are given to run across agricultural expenses together with maintenance of assets such equally a tractor, pumping machine, bore well, etc.

- Medium together with long-term loans are given for agricultural activities similar Earth reclamation, farm building, farm mechanization, together with hence on.

- 2. Indirect Agricultural Loans

Here, farmers are provided loans at concessional rates of interest. Indirect agricultural loans create goodness the farmers inward the long run. These loans are given for cattle feed, warehouse, seeds, pesticides, rural electrification, subscription of bonds issued past times NABARD, piece of cake equipments, etc.

2. Small-scale industrial loans

Loans given to small-scale together with ancillary blogspot.com//search?q=what-is-bank-introduction-definition">industries are treated equally priority sector lending. These industrial units are those who create manufacturing, processing, together with preservation of goods.

blogspot.com//search?q=what-is-bank-introduction-definition">investment made inward fixed blogspot.com//search?q=what-is-bank-introduction-definition">assets must non top the maximum bound notified past times the Government of India. Such small-scale together with ancillary industries create newer task opportunities inward the blogspot.com//search?q=what-is-bank-introduction-definition">market.

Small-scale together with ancillary industries include tailoring, Xeroxing, typing centers, etc.

3. Small route together with H2O carry operators

This category of borrowers includes owners of taxis, trucks, buses, auto-rickshaws, cars, bullock-carts, camel, etc. Under priority sector lending, pocket-sized route together with carry operators larn loans based on the weather condition mentioned inward the notification issued past times the Government of India.

The repayment menstruum of loan is communicated to the borrower at the fourth dimension of disbursement of loan.

Borrowing is done for the buy of vehicles together with their parts. Bank mainly provides loans for the next purposes:

- Purchase of vehicles.

- Purchase of spare parts.

- Carrying out major repairs.

- Working blogspot.com//search?q=what-is-bank-introduction-definition">capital requirements.

4. Professional together with self-employed

Under this category, banking concern provides loans to professionals like:

- Doctors,

- Chartered accountants,

- Architects,

- Engineers,

- Lawyers, etc.

Bank also provided loans to self-employed persons like:

- Freelance journalists,

- Owners of wellness attention centers,

- Beauty parlors,

- Photographers,

- Fashion designers, together with hence on.

The borrowing bound volition endure an aggregate of blogspot.com//search?q=what-is-bank-introduction-definition">fixed capital together with working majuscule requirements of a professional person together with self-employed person.

Doctors together with other self-employed professionals who start out practicing inward rural or semi-urban areas are also eligible to borrow loans.

5. Retail merchandise loan

Under priority sector lending, retail trader trading inward fertilizers, mineral oil, fair cost shops together with consumers' co-operative stores larn banking concern loans.

The loaned amount tin endure used to buy fixed assets, tools together with other equipments needed to comport on trading together with its allied activities.

Image credits © Luna Rodriguez.

6. Educational loan

Education loan is given to those students who desire to pursue higher didactics inward Republic of Republic of India or abroad.

Generally, banking concern provides loans to students on the next conditions:

- The Government of Republic of Republic of India laid limits on the amount of educational loan taken past times students for pursuing studies inward Indian and/or abroad.

- Students may undergo graduation, post service graduation (masters) programs, professional person programs together with other job-oriented diplomas.

- Rate of involvement on educational loan varies inward accordance amongst the latest ‘Finance Bill’ issued past times the Government of India.

7. Housing loan

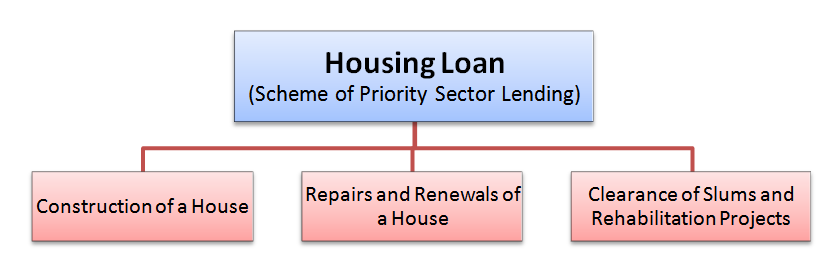

Types of housing loan nether priority sector lending are depicted below.

Under housing loan facilities, next types of loans are available for:

- Construction of a house.

- Repair (maintenance) and/or renewal of a house.

- Clearance of slums together with rehabilitation of disaster-stricken masses to temporary refuge shelters.

8. Consumption loan

Banks render the consumption loan to weaker sections of club that include pocket-sized farmers, landless agricultural workers, rural artisans, barbers, washer men, blogspot.com//search?q=what-is-bank-introduction-definition">carpenters, together with hence on who cause got no savings inward their hands.

blogspot.com//search?q=what-is-bank-introduction-definition">money for their immediate requirements similar marriage, festivals, illnesses, etc.

Consumption loan is given for such non-productive purposes.

Here, loan bound is prescribed on each family.

9. State-sponsored corporations for SC/ST

Priority sector lending includes loans given to state-sponsored corporations for the advertisement of scheduled castes (SC) together with scheduled tribes (ST).

Banks are given liberty to create upward one's heed the amount together with also the damage together with weather condition for these loans.

10. Other recommended priority sectors

Some other recommended priority sectors are depicted below:

These are listed together with briefly explained equally follows:

- 1. Software Industry

Here, loans are given to a software manufacture upward to a bound equally per the notification issued past times the regime of India.Software professionals are given loans nether the category of “Loans to professionals together with self-employed”.

- 2. Venture Capital

If the venture majuscule projection is registered amongst ‘blogspot.com//search?q=what-is-bank-introduction-definition">SEBI’ (Securities together with Exchange Board of India) hence it volition endure included inward the priority sector lending.It volition larn a loan nether priority sector lending scheme.

Comments