Merchant Banking Meaning

Merchant Banking Meaning

Merchant Banking is a combination of blogspot.com//search?q=what-is-bank-introduction-definition">Banking together with consultancy services. It provides consultancy to its clients for financial, blogspot.com//search?q=what-is-bank-introduction-definition">marketing, managerial together with legal matters. Consultancy way to render advice, guidance together with service for a fee. It helps a human being of affairs to begin a blogspot.com//search?q=what-is-bank-introduction-definition">business. It helps to heighten (collect) blogspot.com//search?q=what-is-bank-introduction-definition">finance. It helps to expand together with modernize the business. It helps inwards restructuring of a business. It helps to revive sick trouble organisation units. It besides helps companies to register, purchase together with sell shares at the blogspot.com//search?q=what-is-bank-introduction-definition">stock exchange.

blogspot.com/-i3_mNJTvoDg/UmOF32uTOwI/AAAAAAAAHaU/2jYpXmHt13Q/s1600/What-is-Merchant-Banking-Meaning.png" imageanchor="1" rel="lightbox-Merchant-Banking-Meaning-Functions" title="Merchant Banking Meaning - Functions of Merchant Banking">blogspot.com/-i3_mNJTvoDg/UmOF32uTOwI/AAAAAAAAHaU/2jYpXmHt13Q/s420/What-is-Merchant-Banking-Meaning.png" style="cursor: pointer; display: block; margin: 0px automobile 10px; text-align: center; width: 420px; height: 245px;" />

In short, merchant banking provides a broad make of services for starting until running a business. It acts equally Financial Engineer for a business.

Image credits © Prof. Mudit Katyani.

Merchant banking was kickoff started inwards Republic of Republic of India inwards 1967 past times Grindlays Bank. It has made rapid progress since 1970.

Functions of Merchant Banking

Functions of Merchant Banking

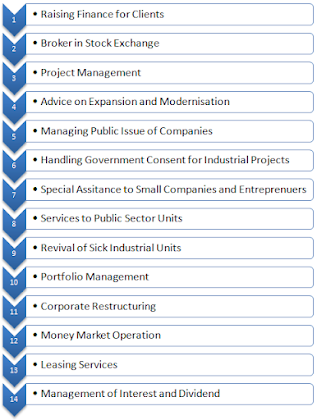

The of import functions of merchant banking are depicted below.

The functions of merchant banking are listed equally follows:

- Raising Finance for Clients : Merchant Banking helps its clients to heighten finance through trial of shares, debentures, banking company loans, etc. It helps its clients to heighten finance from the domestic together with international market. This finance is used for starting a novel trouble organisation or projection or for modernization or expansion of the business.

- Broker inwards Stock Exchange : Merchant bankers deed equally brokers inwards the stock exchange. They purchase together with sell shares on behalf of their clients. They comport query on equity shares. They besides suggest their clients most which shares to buy, when to buy, how much to purchase together with when to sell. Large brokers, blogspot.com//search?q=what-is-bank-introduction-definition">Mutual Funds, Venture blogspot.com//search?q=what-is-bank-introduction-definition">capital companies together with blogspot.com//search?q=what-is-bank-introduction-definition">Investment Banks offering merchant banking services.

- Project blogspot.com//search?q=what-is-bank-introduction-definition">Management : Merchant bankers assistance their clients inwards the many ways. For e.g. Advising most place of a project, preparing a projection report, conducting feasibility studies, making a invention for financing the project, finding out sources of finance, advising most concessions together with incentives from the government.

- Advice on Expansion together with Modernization : Merchant bankers laissez passer on advice for expansion together with modernization of the trouble organisation units. They laissez passer on skillful advice on mergers together with amalgamations, acquisition together with takeovers, diversification of business, unusual collaborations together with joint-ventures, technology scientific discipline up-gradation, etc.

- Managing Public Issue of Companies : Merchant banking company advice together with create out Blue Planet trial of companies. They render next services:

- Advise on the timing of Blue Planet issue.

- Advise on the size together with cost of the issue.

- Acting equally managing director to the issue, together with helping inwards accepting applications together with allocation of securities.

- Help inwards appointing underwriters together with brokers to the issue.

- Listing of shares on the stock exchange, etc.

- Handling Government Consent for Industrial Projects : H5N1 human being of affairs has to larn regime permission for starting of the project. Similarly, a fellowship requires permission for expansion or modernization activities. For this, many formalities stimulate got to hold upward completed. Merchant banks practise all this piece of occupation for their clients.

- Special Assistance to Small Companies together with Entrepreneurs : Merchant banks suggest small-scale companies most trouble organisation opportunities, regime policies, incentives together with concessions available. It besides helps them to convey payoff of these opportunities, concessions, etc.

- Services to Public Sector Units : Merchant banks offering many services to world sector units together with world utilities. They assistance inwards raising long-term capital, marketing of securities, unusual collaborations together with arranging long-term finance from term blogspot.com//search?q=what-is-bank-introduction-definition">lending institutions.

- Revival of Sick Industrial Units : Merchant banks assistance to revive (cure) sick industrial units. It negotiates alongside dissimilar agencies similar banks, term lending institutions, together with BIFR (Board for Industrial together with Financial Reconstruction). It besides plans together with executes the amount revival package.

- blogspot.com//search?q=what-is-bank-introduction-definition">Portfolio Management : H5N1 merchant banking company manages the portfolios (investments) of its clients. This makes investments safe, liquid together with profitable for the client. It offers skillful guidance to its clients for taking investment decisions.

- Corporate Restructuring : It includes mergers or acquisitions of existing trouble organisation units, sale of existing unit of measurement or disinvestment. This requires proper negotiations, grooming of documents together with completion of legal formalities. Merchant bankers offering all these services to their clients.

- Money Market Operation : Merchant bankers bargain alongside together with underwrite short-term blogspot.com//search?q=what-is-bank-introduction-definition">money market instruments, such as:

- Government Bonds.

- Certificate of deposit issued past times banks together with fiscal institutions.

- Commercial newspaper issued past times large corporate firms.

- Treasury bills issued past times the Government (Here inwards Republic of Republic of India past times RBI).

- Leasing Services : Merchant bankers besides assistance inwards leasing services. Lease is a contract betwixt the lessor together with lessee, whereby the lessor allows the utilisation of his specific property such equally equipment past times the lessee for a for sure period. The lessor charges a fee called rentals.

- Management of Interest together with Dividend : Merchant bankers assistance their clients inwards the management of involvement on debentures / loans, together with dividend on shares. They besides suggest their customer most the timing (interim / yearly) together with charge per unit of measurement of dividend.

Comments